Are There Any Benefits To Refinancing A Car

The Pros and Cons of Refinancing a Car Loan Reduce Your Interest Rate. One of these strategies involves refinancing an auto loan.

Do You Get Cash If You Refinance Your Auto Loan

Give it extra-serious thought if your financial situation has improved or interest rates have dropped since you took out your current loan.

/Open_Road_Lending-3538cfb042ad4f988c0ca814212a9f37.jpg)

Are there any benefits to refinancing a car. How did homeowners take advantage of rising housing. However when you refinance your car you can also extend the number of months over which you are repaying the loan. Before you refinance a car loan you need to weigh all the pros and cons related to short-term and long-term outcomes.

There are several situations in which it may be beneficial to refinance your car loan. Refinancing can help reduce your monthly car payment in a couple of ways. Benefits of Refinancing Your Car Better interest rates.

Many people decide that refinancing their vehicle is of benefit and well start by taking a look at some of the reasons why. By far the ideal benefit of refinancing the car loan is to secure a lower interest rate. When Refinancing a Car Loan is a Good Idea There are two common situations when refinancing makes the most sense.

However when you are planning to refinance your car you should consider a few things prior to signing your name on the dotted line of the new loan. One is if youre trying to take advantage of lower interest rates. For example if you extend the term to 60 months from 48 months your monthly payment will be lower.

Depending on what kind of loan you are eligible for refinancing might offer you one or more benefits including. One of the best reasons to refinance a car loan is if you have an opportunity to reduce your. What Does It Mean To Refinance Your Car.

Refinancing a car loan could help you save money in the long run. When you own a business leasing a vehicle becomes an expense that you can deduct from the companys income. Any benefit to refinancing a car to pay off debt.

If you are interested in auto loan refinancing youll be happy to know there are minimal fees associated with a car loan refinance. Here well look at exactly how auto loan refinancing works as well as the benefits of refinancing a car loan. If the stock market is in a more favorable condition now or your credit score has significantly improved since you purchased your car you might be able to secure lower interest rates that could reduce the total amount of interest paid on the.

Be careful though as longer loan terms especially if the interest rate is the same mean higher interest charges. Refinancing a Car Loan to Lower Your Interest Rate. If youre a sole proprietor then this cost could reduce your self-employment obligations.

Todays interest rates may be better than they were when the consumer first purchased the vehicle. Lower Your Monthly Payment. If you had a poor credit score when you first purchased the car your interest rate may be significantly lower than it is right now.

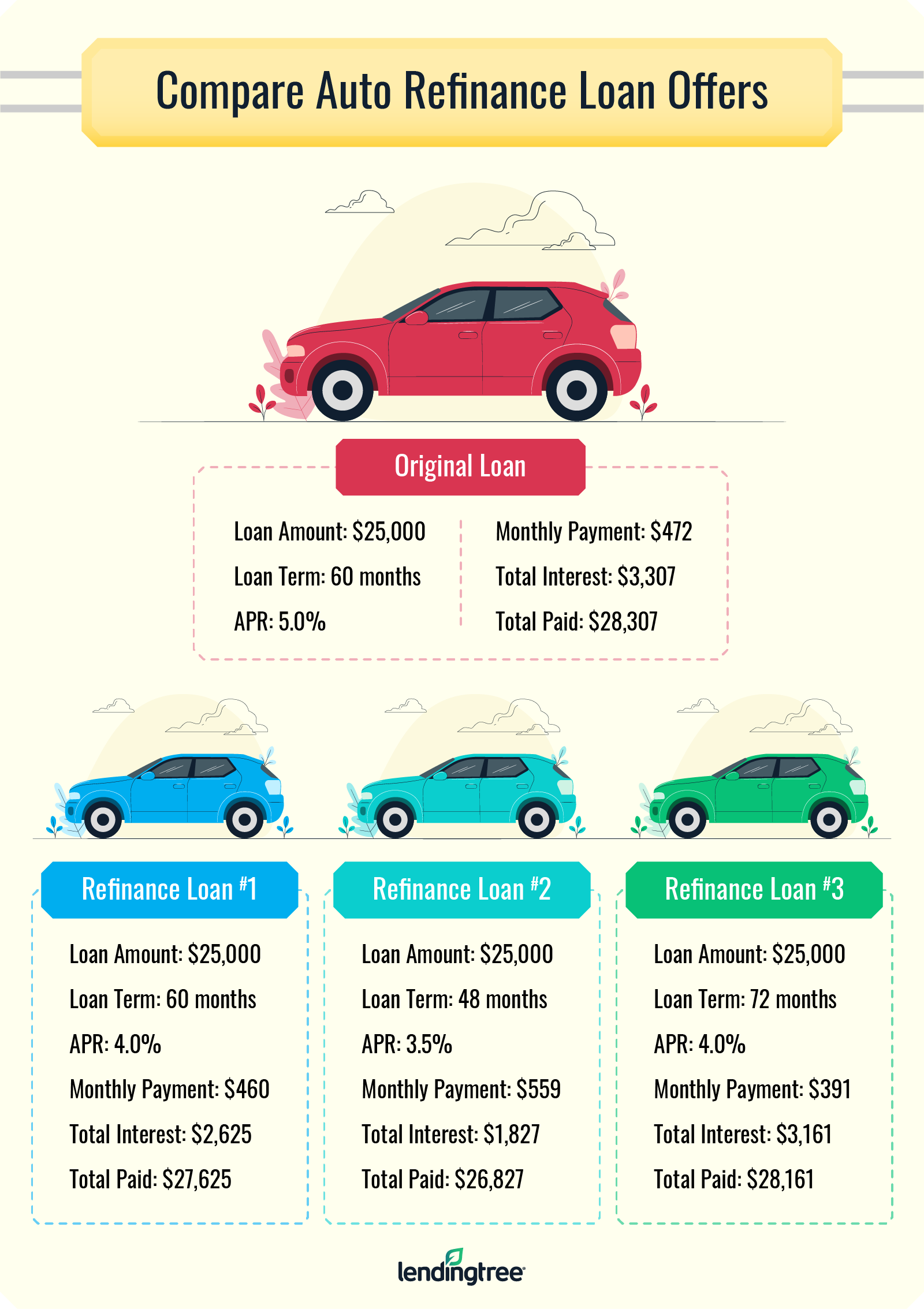

The most common ways to accomplish this in refinancing a car loan are. If youd like to learn more about making car refinancing decisions and other financial planning opportunities please contact us at any convenient time. A lower interest rate APR a lower monthly payment a shorter payoff term the ability to cash out your equity for other uses.

There are 4 key advantages to refinancing your auto loan. First if you secure a lower interest rate the monthly payments could be lower. Lower your interest rate.

Reduce Your Monthly Payment Even if you maintain the same loan length if you reduce your interest rate the monthly payment will go down. A lower interest rate can help you save money on the cost of the loan. Some drivers may experience some tax benefits by leasing instead of buying.

For example if you purchased your car several years ago back when rates were higher you may want to consider refinancing in order to get a better rate. The only real advantage of refinancing is a lower monthly payment. Ramdhan mp February 12 2014 Mortgage Loan.

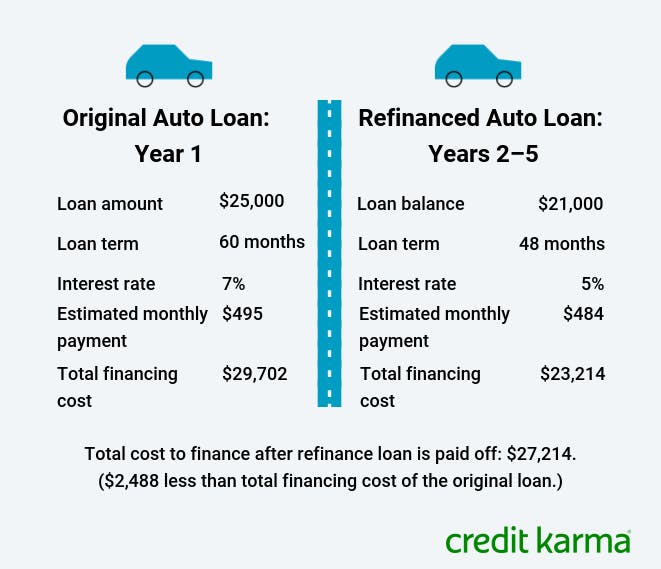

The potential advantages of refinancing are twofold. With refinancing you can free up extra cash which can have a significant impact on your life. Credit Karma receives compensation from third-party advertisers but that doesnt affect our editors opinions.

Second you may be able to extend the term of your loan. Extending your loan term Making the loan term longer brings down your monthly payment. The pros of vehicle refinancing include.

5 comments 1. When you can get a lower interest rate to save money and when you absolutely need a lower monthly payment. It can reduce your monthly payments and lower the overall cost of your car.

Luckily there are several solutions and strategies one can employ to regain control over their finances and achieve economic stability. Sometimes an expensive occurrence such as having a.

How To Refinance A Car Loan In 6 Steps Lendingtree

How Soon Can I Refinance After Buying A Car Rategenius

How To Pay Off Car Loans Faster Tips To Pay Off Your Auto Loans Early Paying Off Car Loan Refinance Car Car Loans

Auto Financing And Refinancing First Republic Bank

How To Refinance Your Car Loan With Bad Credit Credit Karma

I Want To Refinance My Car Loan Should I Use The Same Lender

If I Refinance My Car Loan Will I Lose My Warranty Rategenius

Should I Refinance My Car Loan Before Buying A House Rategenius

/Open_Road_Lending-3538cfb042ad4f988c0ca814212a9f37.jpg)

The 4 Best Auto Refinance Loans Of 2021

When Does Refinancing A Car Loan Make Sense Credit Karma

The 7 Best Auto Refinance Companies Of 2021 Money

When Does Refinancing A Car Loan Make Sense Credit Karma

How To Refinance A Car Loan In 5 Steps Credit Karma

Car Loan Refinance Delta Community Credit Union

Guide To Refinancing A Car How It Works Chase

Can I Refinance My Car With The Same Lender

How To Refinance A Car 3 Quick Simple Steps Badcredit Org

Post a Comment for "Are There Any Benefits To Refinancing A Car"